In 2024, the Group signed the Equity Purchase Agreement with Hong Kong Life Insurance Company.

In 2023, the Group's total assets exceeded 1 trillion yuan.

In 2022, the Group's annual operating revenue exceeded 100 billion yuan for the first time.

In 2012, Guangzhou International Finance Centre was injected into Yuexiu REIT at a valuation of 15.4 billion yuan, successfully establishing a business model that integrates development, operation, and finance.

In 2012 Yuexiu Financial Holdings was established and served as a unified management and development platform for the financial industry. Through a three-pronged approach of capital injection, new establishment, and acquisition, the Group entered into a phase of rapid development.

From 2008 to 2011,Yuexiu Group completed the adjustment and optimization, exited non-core sectors, including hotels, cement, supermarkets, and battery, and formed a modern "3+X" industrial system, which marked the successful transformation into modern service industries.

In 2011, the Group rationalized asset structures between Guangzhou and Hong Kong, establishing smooth cash flow channels for cross-border investments and returns.

In 2009, Yuexiu Investment spun off Yuexiu Transport and was renamed as Yuexiu Property, forming a triangular structure in which the group directly controls two listed platforms.

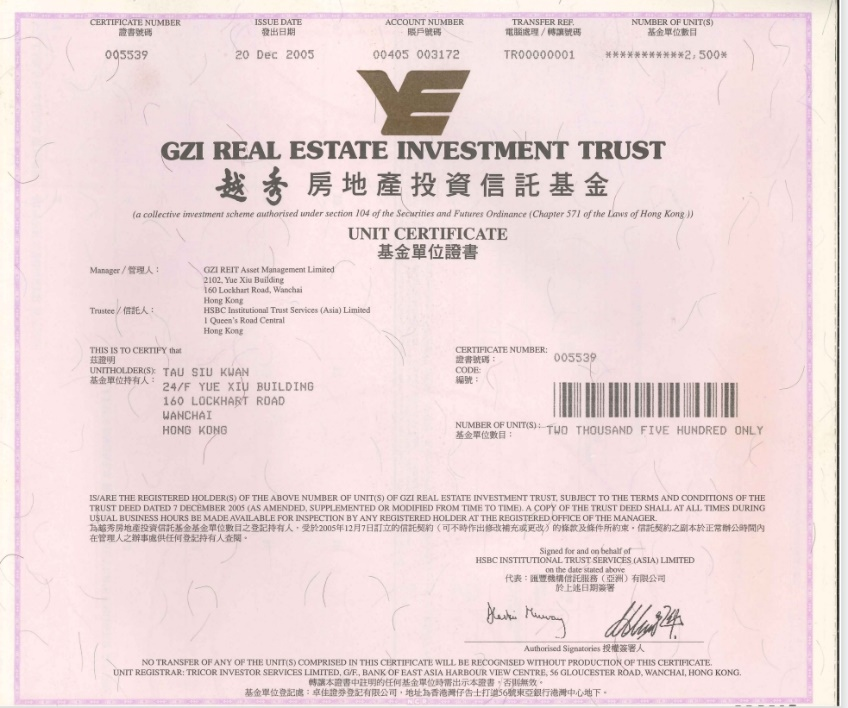

In 2005, Yuexiu Investment spun off and established Yuexiu Real Estate Investment Trust (0405.HK), which was successfully listed in Hong Kong, becoming the world’s first REIT focused exclusively on mainland China’s property market.

Since 2003, the group has gradually developed and formed a diversified industrial structure, encompassing 8 sectors including real estate, transport infrastructure, cement, papermaking, hotel, securities, battery, and international trade.

In 2002, Guangzhou Urban Construction Group conducted a cross-border capital injection into Yuexiu Investment, successfully completing the debt restructuring of the Group.

In 1997, Yuexiu Transport (1052.HK) successfully listed on the Hong Kong Stock Exchange, becoming the first domestic infrastructure stock listed in Hong Kong.

In 1992, Yuexiu Investments (0123.HK) successfully listed on the Hong Kong Stock Exchange, becoming the 9th Red Chip stock listed in Hong Kong.

On April 18, 1985, Yuexiu Enterprises Limited was established in Hong Kong. As the 6th “window company” backed by local government, it conducted trade operations with an initial capital of 5 million US dollars under the principle of "Hong Kong affairs managed by Hong Kong."